BP boss nets £9.45m in two years, Exxon deflects climate blame

Executives at fossil fuel companies reap huge dividends as households go cold, and now believe ‘we waited too long’ to address global warming, despite years of lobbying against climate action.

Murray Auchincloss, recently appointed Chief Executive Officer at BP, took home over £8million in 2023, including a £6.5million bonus. It’s now expected he will receive a salary of £1.45million this year, excluding bonuses, more than 100 times the average yearly salary in Britain.

The company’s profits ‘slipped’ to $13.8billion in 2023, down from a record $27.7billion the previous year, when revenue rocketed due to the energy crisis, while many households descended into fuel poverty.

Last month it was announced that almost a decade after the Paris Climate Agreement, and six years before its stipulated targets should be met, the world had recorded its first annual temperature rise of 1.5C above pre-industrial levels. Limiting warming to this level has been multilaterally agreed by governments across the globe.

In terms of BP’s own progress on net zero, over the past 12 months Scope 1 emissions – which it directly controls – rose by 31.1million metric tonnes year-on-year. However, cumulatively scope 1 and 2 emissions are down 41% compared with 2019, while scope 3 fell by 13% and carbon intensity by 3% in the same period.

But neither the ecological nor capital metrics point to a BP performance worth celebrating, albeit the drop in profit was expected. Nevertheless, Auchincloss’ pay package suggests otherwise, as has been staunchly criticised by environmentalists who are now calling for a ‘serious windfall tax’ on fuel producers, and a ‘CEO bonus tax’ on those leading them.

Elsewhere in the industry, Darren Woods, CEO of Exxon, has been accused of gaslighting, pun surely intended, following an interview with corporate glossy Fortune magazine. When faced with a question as to whether the oil giant is serious about addressing climate change, his subtle response has disturbed analysts.

He explained the company’s business is transforming molecules, which ‘happen to be hydrogen and carbon’ – building blocks of polluting fuels. In contrast, Exxon is not ‘an electron firm’. If it were, renewables such as solar and wind would be the priorities. ‘We don’t see the ability to generate above-average returns for our shareholders,’ Woods replied when asked to explain why the giant isn’t spending more on clean energy.

‘We’ve waited too long to open the aperture on the solution sets in terms of what we need as a society,’ he continued, discussing net zero. By implication, then, he believes we may have missed a chance to reverse the impact of industrialisation. That’s a very different message to the one Woods’ predecessor, Lee Raymond, delivered ahead of the UN Kyoto summit in 1992.

As was claimed then: ‘It is highly unlikely that the temperature in the middle of the next century will be significantly affected whether policies are enacted now or 20 years from now.’ That record paints the situation in sharp relief . Those contributing the most to pollution, habitat destruction, species decline and climate change are now laying blame for something they’ve lobbied against dealing with at the feet of everyone else. Collectively, ‘we’ should have acted sooner.

A 2016 Influencer Map investigation into the use of investor funds by the world’s biggest petroleum companies makes this point painfully clear. ‘Estimating conservatively… these five entities spent almost $115m per year combined on obstructive climate influencing activities, with the bulk by the American Petroleum Institute ($65m), ExxonMobil ($27m) and Shell ($22m),’ the report concluded. You can read it in full here.

Report highlights how to advance and retain women in clean energy

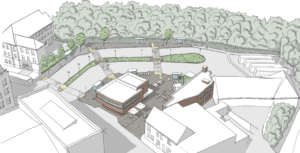

Mersey Energy Centre to get ‘game-changing’ water sourced heat pump

Image: Jared Evans