The continent’s liquefied natural gas terminals saw demand drop by 20% year-on-year, with average utilisation falling 50% in the Q1 2024, while imports from Russia grew.

The data may indicate that an overall decline in the liquefied natural gas [LNG] market is emerging in Europe, raising serious questions about the role of extensive infrastructure built across the continent during recent years. In 2023, the industry saw demand fall to its lowest in a decade, shrinking 5% compared with the preceding 12 month period, with overall gas consumption dropping by 3%.

The research, conducted by the Institute for Energy Economics and Financial Analysis [IEEFA], suggests that European nations have passed peak LNG consumption, despite spending billions on new infrastructure since Moscow’s invasion of Ukraine in 2021 and the subsequent restrictions on Russian gas supplies.

‘Europe’s LNG terminal construction spree might be coming to an end, with some countries delaying or cancelling infrastructure. Since the beginning of 2023, new terminals or expansions have been shelved in Albania, Cyprus, Ireland, Latvia, Lithuania and Poland. It is unclear whether three planned terminals in Greece will go ahead,’ said Ana Maria Jaller-Makarewicz, Lead Energy Analyst, Europe, at IEEFA.

However, imports of LNG into Europe from Russia have increased during the same period, rising 11% year-on-year in the first half of 2024. Figures show huge differences between recipient countries, with deliveries of the fuel into France from the Moscow rocketing by 110%, Spain flatlining and Belgium growing by just 16%. Between the three, these nations accounted for 87% of total continental demand for the gas.

A live tracker is available online and can be found here.

More on energy:

Exxon predicts 2050 global oil demand could be higher than today

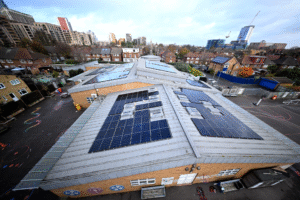

UK schools secure billions in public-private financing for energy efficiency

Cheshire East launches fresh support for home energy upgrades

Image: Carl Nenzen Loven