Resilico: the flood defence app regulating mitigation, insurance and recovery

As storm-battered Britain weathers a winter of high watermarks and devastated homes, we get to grips with a new mobile application safeguarding insurers, households and property owners, reducing costs, improving solutions, and putting an end to rogue traders.

At the time of writing there are more than 100 individual flood warnings in place across the UK, with hundreds already being evacuated in Egham and Chertsey, Surrey, as fire services respond to encroaching waters. This is days after parts of Nottinghamshire were saw villages become islands as the Trent burst its banks.

Cornwall to Yorkshire, the list of areas that have endured major flooding in Britain is long and painful. Each year, the country lays out £2.2billion trying to protect itself against, and recover from, the impact of these disasters. Alarmingly, just £800million of that goes on improving and maintaining coastal defences as the cost of recovery and damage spirals. Currently, UK properties with a combined value of £200billion are considered to be in constant direct threat from flooding – 5.9million of us live on these frontlines.

Flood Re is the Government-backed scheme aimed at making flood cover more affordable as part of household insurance policies. You might say its very existence is a sign of how many addresses now struggle to meet high premiums due to flood risk, or can’t find an insurer willing to cover at all. The programme has a shelf life, and will end in 2039, at which point the plan is returning to risk reflective pricing across the insurance market. Having chaired Defra’s Property Flood Resilience [PFR] round table between 2016 and 2020, Graham Brogden is clear on what that means in reality, and why he feels his work as ambassador for the digital platform Resilico is so important right now.

‘As a nation, we are not ready for that change at all. It seems far off, but the transition is already underway, so Resilico is focused on trying to get people prepared for that – consumers and two sides of the professional industry – improving protections from flooding events, and stopping rogue traders,’ says Brogden, recounting direct experience of the minefield flood recovery can often be.

‘You’ll remember the 2015 Cumbrian floods? 7,500 properties were effected. This was the second time Defra used its Repair & Renew grant system, which offers £5,000 to flood victims, with just one application per household allowed,’ he continues. ‘It was a huge problem to administer, and insurers were massively disrupted waiting to hear if work was going to be covered or not, and in many ways it worked against the goal of getting people back into homes quickly.’

This wasn’t the only major problem. The scheme covered an initial £400 survey to ascertain what, if anything, could be done to reduce flood risk, leading to untrained, unqualified opportunists door-knocking in a bid to cash in. Work was undertaken without relevant experience, shortsighted recommendations were made, and unsuitable solutions installed. Homeowners had false confidence, safe in ignorance of the fact their property had no more protection from flooding than the last time waters ruined the living room.

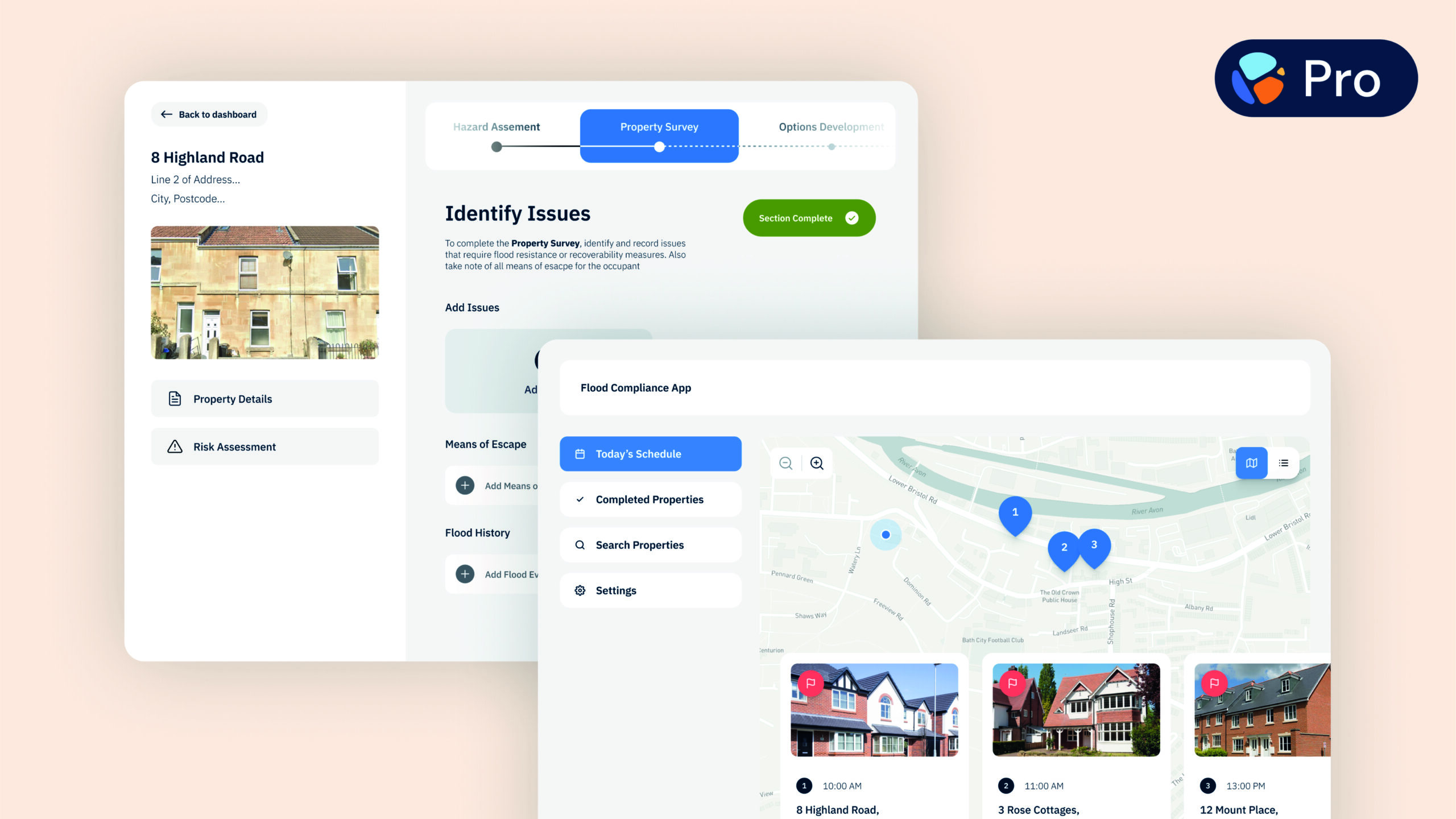

‘So one of the things we wanted to achieve [at Defra PFR] was to get some regulation in the industry. I looked at building regs, but quickly saw that wasn’t going to get very far. So we got some funding, met with the industry, and published six standards in a code of practice. So a hazard assessment must be carried out to begin with, looking at likelihood of flooding, type and depth of the flood. A property survey follows, with site visit conducted by trained professional who knows the initial hazard assessment. They draw up a plan for that specific property,’ says Brogden, explaining feasibility is also key, ensuring work can actually be done in the situation, and by those offering to carry it out.

‘RESILICO itself is a mobile app that takes you through all that step-by step. It makes you think about the flood, the property, and the people. Rather than just one of those aspects. It’s the only thing we are aware of that will allow you to do a survey in line with the code of practice, and it safeguards all parties involved,’ he continues. ‘ Of course, on the industry side people need some training, which is delivered by the Chartered Institute of Water Management [CIWEM].’

Divided into two distinct parts, Resilico’s first ‘side’ is directly aimed at those conducting the surveys, and doing the work – risk assessors, installation professionals, and so forth. Through photos, videos, and notes, the software keeps a full paper trail of every individual action taken at a property to improve flood defence and resilience, from the first assessment to the completion of flood doors and other infrastructure.

Every input is stored and searchable, a database of information including the company that carried out improvements and the specific manufacturer of the products used. This makes deep auditing possible for the very first time, even at scale. So a local authority or housing association can now ascertain exactly why defence work failed. And legitimate suppliers know they have evidence of exactly how improvements were carried out.

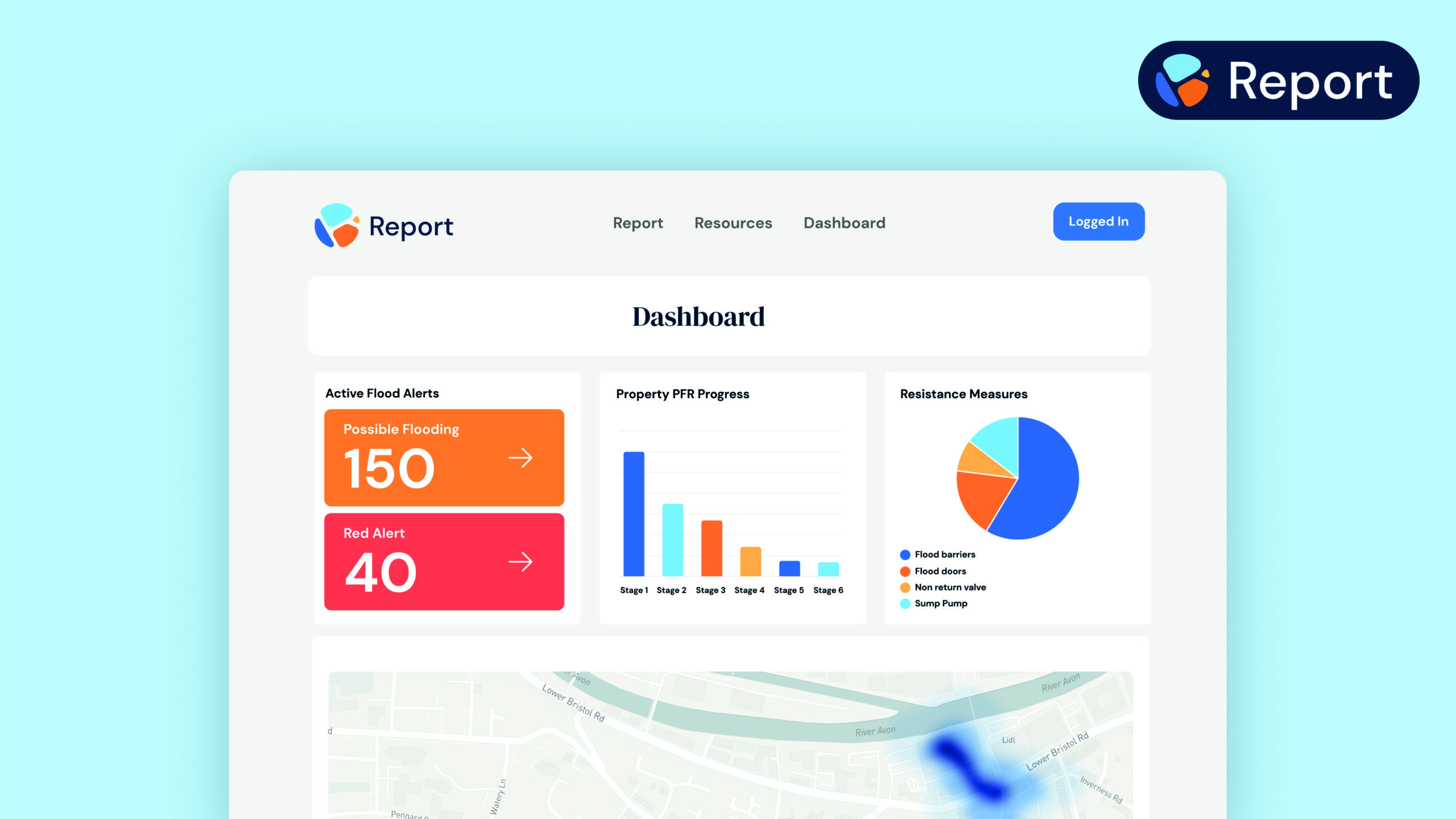

Flipping the focus, Resilico’s other ‘side’ is for homeowners and landlords. Any number of addresses can be added to a single dashboard display. From there, it’s possible to a variety of things, including see the changes that could be implemented to make the property more resilient to flooding, develop custom emergency plans, prompting steps such as ‘turn the gas off’ in the event of evacuation, and receive advance warnings of flood events for specific areas. When any work is done, the record created in the industry end of Resilico will automatically update on both sides.

‘You’re essentially creating an evidence base for your insurer, showing what has been done to protect against flood risk. That’s never been done before and it’s essential if we want people to get back into mainstream insurance,’ says Brogden. ‘The next step is building in the Flood Performance Certificate, which Flood Re is developing. Middlesex University are working on a scoring system for the scheme, like energy efficiency ratings, and we’re bringing that into the platform too.’

While Resilico is an impressive tool in itself, it also serves a less tangible third purpose. Brogden’s goal is to ‘mainstream’ Property Flood Resilience, and he cites the surprisingly small size of the domestic sector, considering the UK’s tendency to flood, as a barrier to affordability. But as more insurers begin to engage – an inevitability with Flood Re’s timeframe and this new industry standardisation – demand for products and services will rise, expanding the sector. ‘Protection from flooding can be quite expensive. That cost will come down as bigger manufacturers enter the market.’

More on flooding and resilience:

Climate change adaptation pathways for local authority masterplans

New flood resource assesses groundwater, 9m homes at risk this winter

Images: Colby Winfield (top) / Jonny Gios (middle) / Resilico (bottom)