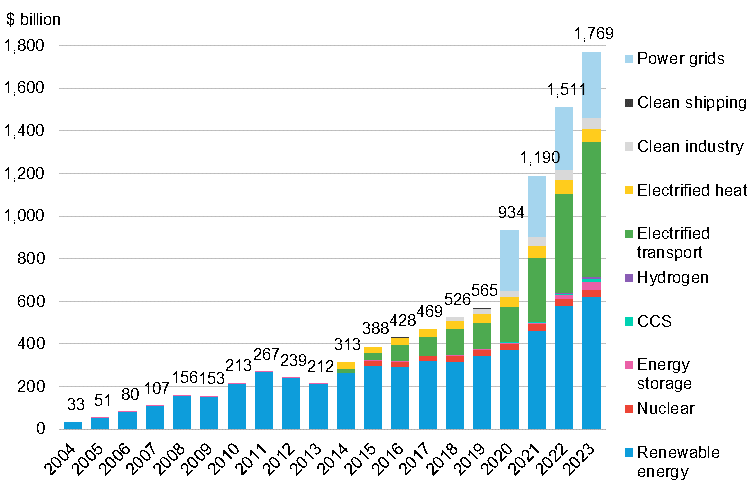

Investment in low-carbon energy surged 17% in 2023

Last year broke all records for renewable financing, but at $1.8trillion the sector still lags far behind where it needs to be.

Published by BloombergNEF, the Energy Transition Investment Trends 2024 report shows that last year $1.8trillion was invested in the clean and renewable energy sector. The figure represents a new annual record for spending, which analysts say reflects the industry’s resilience in spite of major geopolitical turbulence.

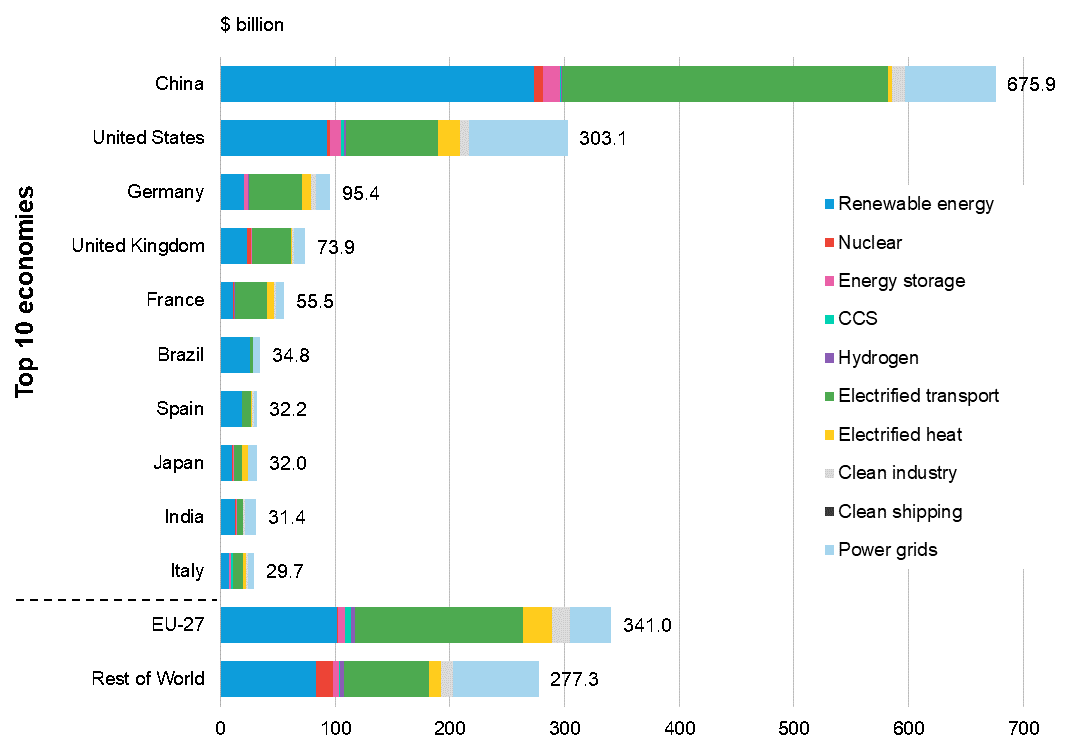

China led the spending spree, with $676billion allocated to projects in the second most-populous country on the planet. Equivalent to 38% of total worldwide expenditure, almost as much as the UK, US, and EU combined, which saw $784billion invested.

China also saw it financing decline, while the latter three economic areas increased, with Britain topping this metric, with 84% growth driven by strong EV sales and grid projects. Electrified transport was the number one sector for clean energy spending, up 36% on 2022 to $634billion, overtaking renewable energy, which was enjoyed $623billion in the same period. Power grids alone accounted for $310billion.

Global energy transition investment by sector

Top 10 economies for 2023 energy transition investment, plus EU-27 and rest of world

While these numbers are huge, they still fall well sort of the investment levels needed to hit net zero emissions by 2050. It is estimated that $4.8trillion will need to be spent annually until the end of this decade to reach that target and align with BNEF’s New Energy Outlook Net Zero Scenario.

‘Last year brought new records for global renewable energy investment. Strong growth in the US and Europe drove the global rise, even as China, the world’s largest renewables market, sputtered, recording an 11% drop. Despite a year of tough headlines, a record amount of offshore wind capacity also reached financial close,’ said Meredith Annex, BNEF’s Head of Clean Power and co-author of the report.

‘Our report shows just how quickly the clean energy opportunity is growing, and yet how far off track we still are,’ added Albert Cheung, Deputy CEO of BNEF. ‘Energy transition investment spending grew 17% last year, but it needs to grow more than 170% if we are to get on track for net zero in the coming years. Only determined action from policymakers can unlock this kind of step-change in momentum.’

More on energy:

New world record set for solar energy efficiency as market booms

Itemised electricity bills save British households up to 30%

Images: Matthew Henry (top), BNEF (graphs)