Carbon credits could be worth $238 per tonne by 2050

BloombergNEF’s latest report suggests the burgeoning sector is about to face its toughest challenges yet.

The voluntary carbon market had a mixed year in 2023, with serious issues surrounding public perception of legitimacy and the sector’s reputation.

The coming months will therefore prove pivotal in whether confidence can be restored, according to Bloomberg NEF’s Long-Term Carbon Offsets Outlook 2024. If the industry successfully overcomes the setbacks and faith is re-established, it could trigger a massive uptake of investment, with companies poised to buy billions in credits, sending values soaring to $200 per tonne and the overall market to $1.1trillion by 2050.

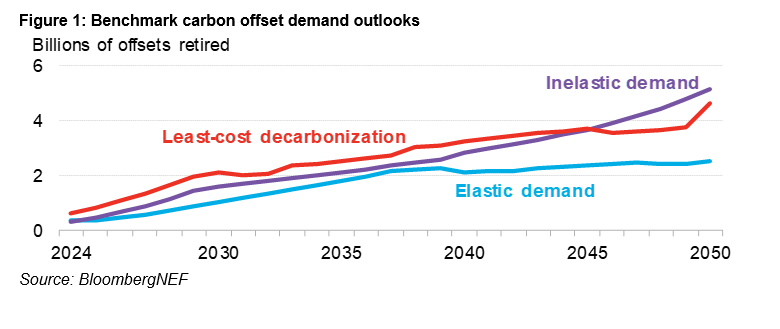

Although the 12 months to January saw record annual demand, signs the sector is slowing are visible — 2023’s overall activity was just 2% higher than 2021. The market is also now considered to be oversupplied, with 50% more credits than buyers at the last analysis. This ‘elastic demand’ has partly been driven by companies choosing not to purchase for fear of criticism amid successive scandals that have rocked the industry and called into question the real terms impact and validity of credits. Prices are also a big concern.

Several initiatives have launched to try and rebuild trust, including the Integrity Council on Voluntary Carbon Markets, while the US has issued new guidance through the Commodities Further Trading Commission. The intention is to establish ‘inelastic demand’.

‘There is no shortage of governments and investors that are eager to monetize emission reductions through carbon credits and channel financing towards projects,’ said Kyle Harrison, Head of Sustainability Research at BNEF. ‘But if buyers can’t trust the quality of the credits they’re buying and risk greenwashing accusations, then the market will never reach its potential. Credits will never be more than discretionary spend in this case.’

Three potential scenarios are identified in the report. In the first — ‘high quality scenario’ — inelastic demand is established by overcoming integrity issues. In this case, prices are low in early years, at around $20 per tonne in 2030, but increase rapidly towards $238 per tonne in 2050.

The ‘voluntary market scenario’ does not foresee reputation improvement, and instead envisions elastic demand, fluctuating over time. Here, prices reach just $13 per tonne by 2030, and only rise to $14 by 2050, leading to further criticism credits are merely a ‘license to pollute’.

Finally, the ‘removal scenario’ would mean the industry switches tact, so companies are only allowed to buy carbon removals, and credits are interchangeable with other forms of abatement. This offers the most attractive mid-term financials, with prices hitting $146 per tonne by 2030, and $172 per tonne by 2050.

‘The lack of progress at COP28 on Article 6 has been a wakeup call to the importance of the voluntary carbon market,’ added Harrison. “The private sector has been hard at work to position carbon credits as a complement to a suite of other decarbonisation options, including the compliance market. Their success may just be the difference between the private sector achieving or not achieving its net-zero goals.’

More on carbon credits:

Can Treefera restore trust in offsetting with AI reforestation, conservation?

After greenwashing: A guide to effective environmental and offsetting targets

Images: Sigmund